The integration of AI in trading has revolutionized the way traders operate, making it possible to automate complex strategies and improve decision-making. As the forex landscape continues to evolve, it's crucial to stay ahead of the curve by utilizing the most effective AI-powered tools available.

Key Takeaways

- Discover how AI is transforming the Forex trading landscape.

- Explore the top AI-powered Forex trading systems.

- Understand the unique features and strengths of each system.

- Learn how to choose the best AI trading system for your needs.

- Gain insights into the future of Forex trading with AI.

Understanding AI in Forex Trading

AI-powered tools are transforming the forex trading landscape by providing traders with advanced methods to identify and act on market patterns. These tools process both historical and real-time data across various timeframes, uncovering patterns and connections that might go unnoticed by human traders.

How AI is Transforming the Forex Market

The introduction of AI in forex trading has fundamentally changed the market landscape. AI algorithms can process vast amounts of market data in milliseconds, identifying patterns and correlations that would take humans hours or days to discover. This capability has introduced a new era of algorithmic trading, making it possible for traders to react to market changes much faster than before.

Modern AI trading tools combine technical indicators, fundamental analysis, and sentiment data to generate more accurate trading signals. This integration has democratized algorithmic trading, making advanced trading strategies accessible to retail traders rather than just institutional investors.

The Evolution of Automated Trading Systems

The evolution of automated trading systems has been significant, from simple rule-based automation to sophisticated machine learning algorithms that can adapt to changing market conditions. AI helps overcome human limitations like emotional decision-making and fatigue, allowing for 24/7 market monitoring and consistent execution.

As AI continues to evolve, it is likely to play an even more critical role in forex trading, providing traders with more sophisticated tools for analysis and decision-making. The future of forex trading is increasingly tied to the development of AI and automation technologies.

Benefits of Using AI for Forex Trading

The integration of Artificial Intelligence (AI) in Forex trading has revolutionized the way traders analyze and interact with the market. AI's capabilities in processing vast amounts of data, recognizing patterns, and making predictions are transforming the trading landscape.

Enhanced Pattern Recognition and Analysis

AI systems excel at identifying complex patterns in Forex charts that may elude human traders. By analyzing multiple timeframes simultaneously, AI tools provide a comprehensive view of market conditions, enabling traders to make more informed decisions. For instance, tools like the Tickeron Pattern Search Engine scan thousands of Forex charts to predict breakout prices and target levels with confidence.

Emotion-Free Trading Decisions

One of the significant advantages of AI in Forex trading is its ability to remove emotional biases from trading decisions. AI systems stick to predefined trading strategies, even during volatile market conditions, potentially leading to more disciplined trading and better long-term results.

24/7 Market Monitoring

AI trading systems can monitor markets around the clock, scanning for opportunities across different currency pairs without fatigue. This continuous monitoring allows traders to capitalize on market movements at any time, giving them a competitive edge in the Forex market.

Key Features to Look for in AI Forex Trading Systems

When selecting an AI for Forex trading, it's crucial to consider the key features that distinguish top-tier systems from the rest. A robust AI Forex trading system should offer a combination of advanced technical analysis, risk management, and seamless integration with trading platforms.

Pattern Detection Capabilities

Effective AI Forex trading systems should be able to detect complex patterns in the market, including classic chart patterns, candlestick formations, and support/resistance levels. These pattern detection capabilities enable traders to identify potential trading opportunities and make informed decisions.

- Recognition of chart patterns and candlestick formations

- Identification of support and resistance levels

- Analysis of market trends and sentiment

Backtesting Functionality

Backtesting functionality is crucial for validating AI trading strategies against historical market data. This feature allows traders to assess the performance of their strategies and make necessary adjustments before deploying them with real capital.

Risk Management Tools

Integrated risk management tools are essential for controlling potential losses and maximizing gains. These tools can automatically set stop-losses, take-profits, and position sizing based on account balance and volatility, helping traders to manage their risk exposure effectively.

Platform Integration Options

The best AI Forex trading systems offer seamless integration with popular trading platforms like MetaTrader and TradingView. This integration simplifies the trading process, allowing traders to focus on their strategies while the AI handles the technical details.

By considering these key features, traders can select an AI Forex trading system that meets their needs and enhances their trading performance.

LuxAlgo: Best Overall AI for Forex Trading

For traders seeking a robust AI solution, LuxAlgo stands out from the crowd. LuxAlgo provides a well-rounded toolkit for forex traders, featuring price action analysis, trade setup filtering, AI-powered backtesting, and seamless TradingView integration.

Overview

LuxAlgo is designed to cater to the needs of forex traders by offering a comprehensive suite of tools. Its intuitive interface and community-driven approach make it accessible to traders of various skill levels. With LuxAlgo, traders can leverage AI-powered backtesting to validate their strategies against historical data.

Pros

LuxAlgo's strengths include its advanced pattern detection capabilities, which can identify complex chart formations such as head and shoulders patterns, double tops/bottoms, and various triangle formations. Additionally, its seamless integration with TradingView allows traders to visualize AI-generated signals directly on their charts.

Cons

While LuxAlgo offers a robust set of features, it relies heavily on TradingView, which might be a limitation for some users. Furthermore, it lacks direct trade execution capabilities, requiring traders to execute trades manually.

Key Features and Pricing

LuxAlgo's pricing starts at $24.99/month, offering a range of features including AI-powered backtesting, trade setup filtering, and community support. The platform's key features are designed to enhance trading strategies and provide traders with a competitive edge in the forex market.

By offering a balanced feature set and a user-friendly interface, LuxAlgo has become a top choice among forex traders. Its 24/7 community support and educational resources further enhance its appeal.

TrendSpider: Best for Automated Technical Analysis

For traders seeking to automate their technical analysis, TrendSpider stands out as a top choice. Its AI-driven charting and real-time alerts make it an indispensable tool for trading professionals.

Overview

TrendSpider provides AI-driven charting and real-time alerts, starting at $39/month. It quickly identifies chart patterns for traders looking to automate parts of their technical analysis, emphasizing real-time pattern recognition and simple automation.

Pros

TrendSpider's AI algorithms can automatically detect support/resistance levels, trend lines, and chart patterns across multiple timeframes simultaneously. Its real-time alert system notifies traders when specific technical conditions are met, allowing them to act quickly on emerging opportunities.

Cons

While TrendSpider offers robust features, it has a moderate learning curve, which may deter some users. Additionally, its backtesting functionality is somewhat limited compared to some competitors.

Key Features and Pricing

TrendSpider's key features include AI-driven charting, real-time alerts, and backtesting capabilities. Pricing starts at $39/month, with various subscription levels offering additional features and support. Traders can validate their technical analysis strategies against historical market data, enhancing their trading decisions.

AlgoTrader : Best for Professional Traders

AlgoTrader is a sophisticated AI trading platform tailored for professional traders seeking advanced algorithmic trading capabilities. With its robust machine learning algorithms, AlgoTrader provides predictive analytics that forecast potential market movements, identifying high-probability trading opportunities.

Overview

AlgoTrader is designed for professional traders who require sophisticated tools for algorithmic trading. Its predictive analytics use machine learning to forecast market movements, allowing traders to make informed decisions. The platform's comprehensive risk management tools help protect capital while maximizing returns.

Pros

AlgoTrader's key advantages include its advanced algorithmic trading capabilities, risk management tools, and multi-exchange support. This allows professional traders to execute strategies across different forex brokers from a single interface, streamlining their trading operations.

Cons

While AlgoTrader offers powerful features, it has a steep learning curve for beginners, and its premium pricing (starting at $299/month for the Professional plan) may be a barrier for some traders. However, for professional traders, the advanced features and analytics justify the cost.

Key Features and Pricing

AlgoTrader's Professional plan is priced at $299/month, offering advanced features such as predictive analytics, algorithmic trading, and comprehensive risk management. The platform's multi-exchange support allows traders to execute strategies across different forex brokers, making it a versatile tool for professional traders.

XAUBOT: Best for Gold Trading Automation

XAUBOT stands out as a premier AI trading system, specifically designed to excel in automating gold (XAU/USD) trading strategies. While it can handle other forex pairs, its advanced capabilities make it particularly well-suited for gold trading.

Overview

XAUBOT is an automated trading platform that utilizes top-of-the-line AI-based expert advisors to automate the trading process in the foreign exchange market. It implements two main trading strategies: scalping for short-term trades and multi-level trading for longer timeframes.

Pros

XAUBOT's key advantages include its advanced risk management approach and highly profitable multi-level trading strategy. These features make it an ideal expert advisor for prop trading, helping users pass prop challenges with ease.

Cons

One limitation of XAUBOT is its primary focus on gold trading, which might not appeal to traders interested in a broader range of currency pairs. Additionally, the complexity of its multi-level trading strategy may require a learning curve for some users.

Key Features and Pricing

XAUBOT's key features include technical analysis capabilities using indicators like RSI and Bollinger Bands, as well as fundamental analysis that adjusts trading behavior around high-impact economic news releases. The platform offers various subscription options, with pricing tiers that include different levels of features and support. Traders can choose a plan that best suits their needs and budget.

QuantConnect: Best for Cloud-Based Strategy Development

QuantConnect is revolutionizing the forex trading landscape with its cloud-based AI platform. This innovative tool allows traders to develop, backtest, and deploy algorithmic trading strategies without the constraints of hardware limitations. By supporting multiple programming languages, including C#, Python, and F#, QuantConnect makes it accessible to traders with various coding backgrounds.

Overview

QuantConnect is a cloud-based platform that offers a comprehensive solution for traders looking to leverage AI in their trading strategies. With its extensive historical data library spanning multiple asset classes, QuantConnect enables comprehensive backtesting of forex trading strategies. This feature is particularly valuable for traders seeking to refine their approaches.

Pros

One of the key advantages of QuantConnect is its support for machine learning and multi-asset trading. The platform's community features allow traders to share ideas, collaborate on strategies, and learn from each other. This collaborative environment can be a significant boost for traders looking to improve their skills.

Cons

Despite its many benefits, QuantConnect has a steep learning curve for non-programmers, which can be a barrier to entry. Additionally, advanced data and computing needs may incur higher costs, potentially making it less accessible to some traders.

Key Features and Pricing

QuantConnect's pricing starts at $100/month, with various features included at different subscription levels. The platform offers a range of tools for trading strategy development, including backtesting and deployment capabilities. Traders can choose a plan that best suits their needs and budget.

Top Brokers with Integrated AI Trading Tools

The integration of AI tools into trading platforms has revolutionized the way traders operate in the forex market. Top brokers are now incorporating AI into their systems, providing traders with a more streamlined experience.

OANDA: Best Overall AI Trading Platform

OANDA stands out for its competitive spreads, averaging 1.50 pips on EUR/USD, and its execution speed of sub-90ms, offering unmatched trading conditions. The OANDA Trade platform features Autochartist for automated AI-generated technical analysis.

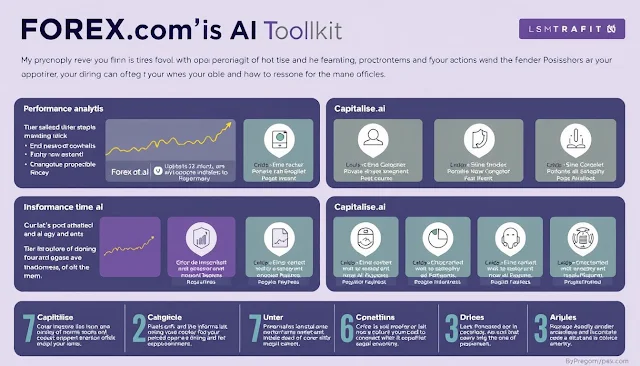

FOREX : Most Comprehensive AI Tools

FOREX offers a comprehensive AI toolkit, including 'Performance Analytics' to highlight strengths and weaknesses, and Capitalise.ai for no-code automation of trading strategies. These tools help traders improve their performance and automate their trading.

eToro: Best for AI-Powered Copy Trading

eToro is a top choice for copy trading, thanks to its AI-powered system that helps traders find and replicate the strategies of successful traders based on their risk preferences and trading goals.

TastyFX: Most User-Friendly AI Platform

TastyFX is ideal for beginner forex traders, offering an easy-to-open trading account, low spreads, and solid customer support. Its user-friendly AI platform features automated technical analysis tools like ProRealTrend.

When choosing a broker with integrated AI trading tools, consider factors such as spreads, execution speeds, and account options to find the best platform for your AI trading needs.

Comparison of Top AI Forex Trading Systems

With numerous AI forex trading systems available, a comprehensive comparison is necessary to identify the best fit for different trading needs. The top systems offer a range of features and capabilities that cater to various trading styles and preferences.

Feature Comparison

The following table provides a detailed comparison of the key features offered by the top AI forex trading systems:

| Tool | Key Features | Pros | Cons | Pricing |

|---|---|---|---|---|

| LuxAlgo | Advanced indicators, AI backtesting, TradingView integration | Robust features at a competitive price, active community, educational support | No direct trade execution, relies on TradingView | Starting $24.99/month |

| TrendSpider | AI detection, real-time alerts | User-friendly, fast pattern spotting | Limited backtesting, moderate learning curve | $39/month |

| AlgoTrader | Predictive analytics, automation, multi-exchange support | Professional-grade, strong risk tools, powerful automation | Harder for beginners, higher cost | $299/month (Pro) |

| Kavout | Machine learning, historical data analysis, market prediction | AI-focused, continuous improvement, anticipates patterns | Small user community, fewer integrations | Custom pricing |

| QuantConnect | Cloud-based, multi-asset trading, community algorithms | No hardware needs, highly flexible, strong community support | Steep learning curve, can get pricey for advanced needs | $100/month |

Pricing Comparison

Pricing is a critical factor when choosing an AI forex trading system. The platforms vary significantly in their pricing structures, reflecting the range of features and level of support offered.

LuxAlgo offers the most competitive pricing, starting at $24.99/month, making it an attractive option for traders on a budget. In contrast, AlgoTrader is priced at $299/month for its Pro version, targeting professional traders who require advanced features and support.

Performance Analysis

The performance of AI forex trading systems can be evaluated based on factors such as the accuracy of signals, speed of execution, and adaptability to changing market conditions.

TrendSpider excels in automated technical analysis, offering real-time alerts and fast pattern spotting. XAUBOT is particularly effective for gold trading automation, demonstrating the importance of choosing a system that aligns with specific trading goals.

As highlighted by a trading expert, "The key to successful trading lies in selecting a platform that matches your trading style and needs." This comparison underscores the diversity in AI forex trading systems and the importance of evaluating features, pricing, and performance to make an informed decision.

"The right AI forex trading system can significantly enhance trading performance by providing accurate signals and efficient execution."

How to Choose the Right AI for Forex Trading

With numerous AI Forex trading systems available, choosing the right one depends on several factors. Traders must consider their individual goals, trading style, and technical know-how to make an informed decision.

Matching AI Tools to Your Trading Style

Different trading styles, such as day trading, swing trading, or scalping, require unique AI capabilities. For instance, day traders may prefer AI tools that offer real-time pattern detection and rapid execution, while swing traders might focus on AI systems that provide robust risk management features.

Budget Considerations

Budget is a crucial factor when selecting an AI Forex trading system. Options range from affordable choices like LuxAlgo at $24.99/month to premium services like AlgoTrader at $299/month. Traders must evaluate the return on investment and choose a tool that aligns with their financial goals.

Technical Requirements

The technical requirements for running AI trading systems vary. Some platforms require advanced programming knowledge and high-performance hardware, while others offer user-friendly interfaces accessible to beginners. Traders should assess their technical expertise and choose an AI system that matches their capabilities.

Ultimately, the right AI for Forex trading is one that aligns with your trading style, fits your budget, and meets your technical requirements. By carefully evaluating these factors, traders can make an informed decision and maximize their potential for success.

Conclusion

As we conclude our comprehensive review of AI forex trading systems, it's clear that the right tool can significantly enhance your trading performance. Each AI tool offers advanced pattern recognition, real-time alerts, and backtesting capabilities that can enrich your forex trading experience. The key is to choose a system that aligns with your individual goals, budget, and technical expertise. While LuxAlgo stands out as our top overall recommendation, other platforms excel in specific areas. Ultimately, combining AI-driven insights with personal market knowledge yields the best results.

FAQ

What is the role of technical analysis in AI-powered Forex trading?

Technical analysis plays a crucial role in AI-powered Forex trading by enabling the identification of chart patterns and trends, which inform trading decisions.

How do risk management tools impact AI-driven trading strategies?

Risk management tools are essential in AI-driven trading strategies as they help mitigate potential losses by setting stop-loss orders and position sizing, thus protecting trading accounts.

Can AI trading systems be integrated with existing trading platforms?

Yes, many AI trading systems offer platform integration options, allowing users to connect with their preferred trading platforms and execute trades seamlessly.

What are the benefits of using algorithmic trading in Forex markets?

Algorithmic trading offers several benefits, including emotion-free trading decisions, 24/7 market monitoring, and the ability to process vast amounts of market data quickly.

How do I choose the right AI Forex trading system for my needs?

To choose the right AI Forex trading system, consider factors such as your trading style, budget, and technical requirements, and evaluate the system's features, performance, and pricing.

What kind of support can I expect from AI Forex trading system providers?

Reputable AI Forex trading system providers typically offer customer support and resources, such as tutorials and documentation, to help users get started and resolve any issues.

Can AI trading systems be used for other financial markets besides Forex?

While some AI trading systems are specifically designed for Forex, others can be used for other financial markets, such as stocks, futures, or commodities, depending on the system's capabilities.